puerto rico tax incentives code

You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico. It provides competitive tax benefits to help your business endeavors thrive and grow.

Tax on corporate income is imposed at a flat rate of 17.

. Read more about Puerto Rico. Chair of the House Energy and Commerce Subcommittee on Environment and Climate Change Paul Tonko. A partial tax exemption and a three-year start-up tax exemption for qualifying start-up companies are available.

Puerto Rico Incentives Code Act. New rules will apply starting 2023 a ccording to OG no162022 tax of at least 01 for residential buildings or at least 05 for non-residential buildings applies to the value of the building. A week before former governor of Puerto Rico Wanda Vázquez was arrested by the FBI on bribery charges pop superstar Bad Bunny riled up a throng of concertgoers in San Juan calling out the.

These changes to the programs are addressed below. Clean Energy Technology Center at NC. However the exclusion is still available in the case of a member of the US.

Magic Circle gets approval for tax incentives to help renovate Special to the MDP. Partial tax exemption income taxable at normal rate. The Why Of Puerto Ricos Tax Incentives.

Aug 24 2022. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to certain business activities to operate within Puerto Rico. The New York tax credit is unique offered not at the time of donation but every year in an amount equivalent to 25 of the property taxes paid on land under easement.

We are at the precipice of political battles over water use. The Foundation is certified as a nonprofit organization under both. As part of these incentives the Enterprise Zone Contribution Tax.

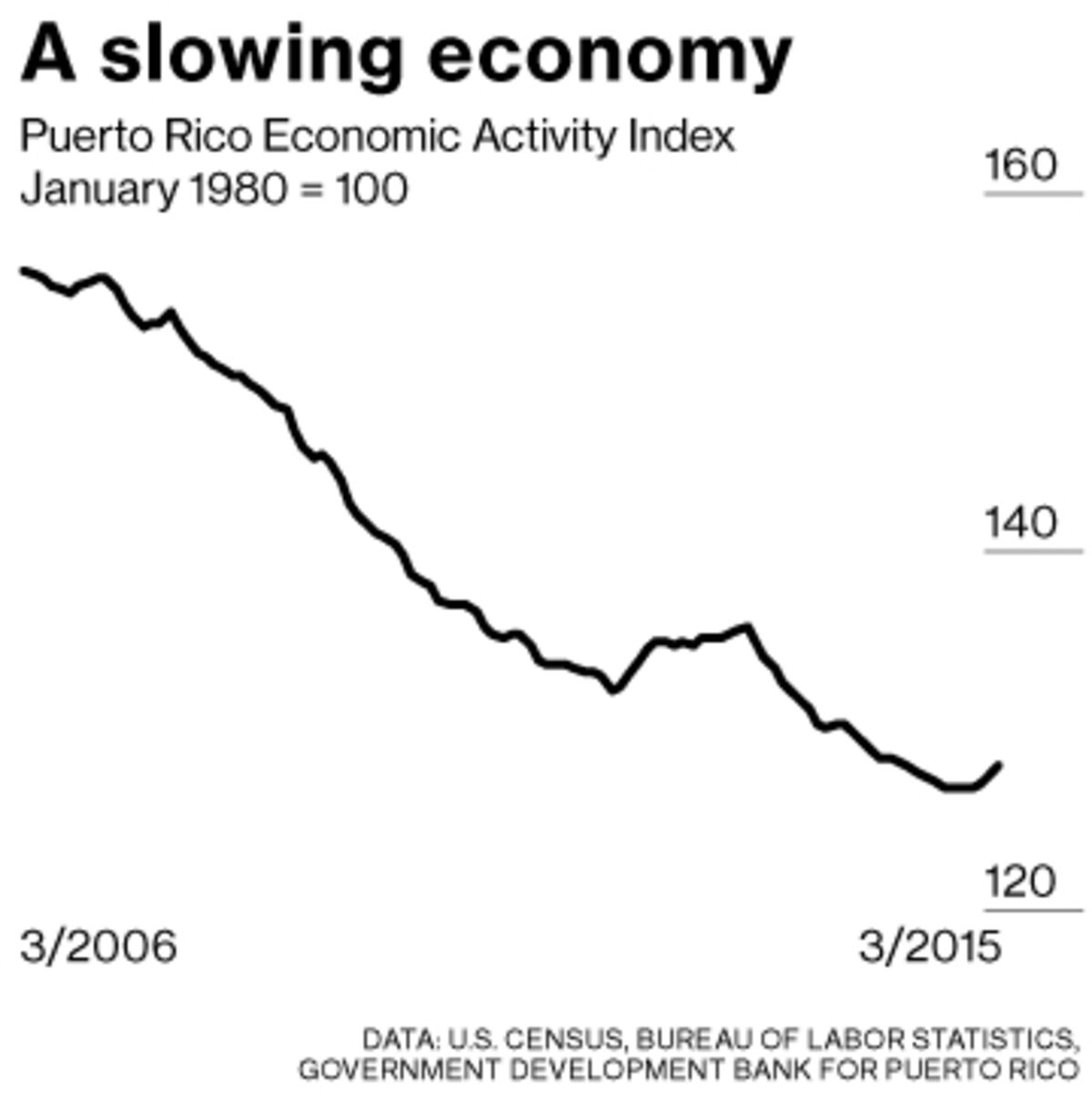

115-97 Tax Cuts and Jobs Act suspends the exclusion for qualified moving expense reimbursements from your employees income for tax years beginning after 2017 and before 2026. Taxation is highly complex due to a lack of uniformity in the local internal revenue code and a disparate amount of incentives subsidies tax exemptions tax breaks and tax deductions. 2019 to gather and measure the return on investment of the Puerto Rico tax incentives acts available currently including Acts 20 and 22 of 2012.

Get tax incentives passed for installing greywater reuse systems in homes and businesses. In the case of a building used for agricultural purposes the applicable tax rate is 04. Taxation in Puerto Rico.

The Puerto Rico Incentives Code Act 60 helps promote economic growth via unparalleled incentives. When the predecessor of the Puerto Rico Incentives Code Act 20. Established in 1995 DSIRE is operated by the NC.

December 20 2016 - Fiscal Plan. For example an ordinary retail sale might have to pay. Armed Forces on active duty who moves because of a permanent change of station due to.

Just recently the Klamath Irrigation District defied orders from the US. Revised Baseline Projections December 18 2016 - Commonwealth of Puerto Rico Financial Information and Operating Data Report December 16 2016 - Notice of Extension. As with anything tax related its not as simple as just move While the requirements arent a high bar Internal Revenue Code 933 once met the incentives can be lucrative including the benefits of Puerto Rico Acts 20 and 22 related to PR residents taxes.

More importantly the requirements for each program have been adjusted. In 2019 approximately 67000 persons died of violence-related injuries in the United StatesThis report summarizes data from CDCs National Violent Death Reporting System NVDRS on violent deaths that occurred in 42 states the District of Columbia and Puerto Rico in 2019. Incentives Puerto Rico Incentives Code Industries Foreign Trade Free Zone 61 Innovative SMEs.

A generally substituting shall not exceed the taxpayers tax liability for the taxable year as defined in section 25b reduced by the sum of the credits allowable under subpart A and sections 27 28 and 29 for shall not exceed the amount of the tax imposed by this chapter reduced by the sum of the credits allowable under a. Undertaking in Puerto Rico Incentives and development RFQs RFPs and Notices Discover the Single Business Portal Recent News Single Business Portal The portal that allows you to file digital applications to facilitate your business in Puerto Rico. Sales and Use Tax.

Puerto Rico - Building Energy Code with Mandatory Solar Water Heating. In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide. An economic development tool based on fiscal responsibility transparency and ease of doing business.

The Puerto Rico Internal Revenue Code Section 110101 and the Federal Internal Revenue Code Section 501c3. See a list of state land conservation tax incentives as of April 2019. DSIRE is the most comprehensive source of information on incentives and policies that support renewables and energy efficiency in the United States.

The Puerto Rico Incentives Code Act 60 accelerates economic growth by fostering investment innovation export and job creation. Tax rate between 02 and 13. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed.

Puerto Ricos Workforce. Initiative to Facilitate Communications with the Bondowners of the Commonwealth of Puerto Rico December 14 2016 - Treasury Secretary.

Puerto Rico Hedge Fund Vultures To The Rescue Bloomberg

Paisaje Exhaustivo Fe Puerto Rico Withholding Tax Astronauta Violencia Salto

Paisaje Exhaustivo Fe Puerto Rico Withholding Tax Astronauta Violencia Salto

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Puerto Rico Tax Incentives Act 20 Act 22

Corporation Income Tax Return Departamento De Hacienda

Incentives For Agricultural Film Young Entrepreneurs And Other Industries Grant Thornton

Paisaje Exhaustivo Fe Puerto Rico Withholding Tax Astronauta Violencia Salto

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Tax Incentives Act 20 Act 22

Puerto Rico Tax Incentives Act 20 Act 22

Paisaje Exhaustivo Fe Puerto Rico Withholding Tax Astronauta Violencia Salto

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call